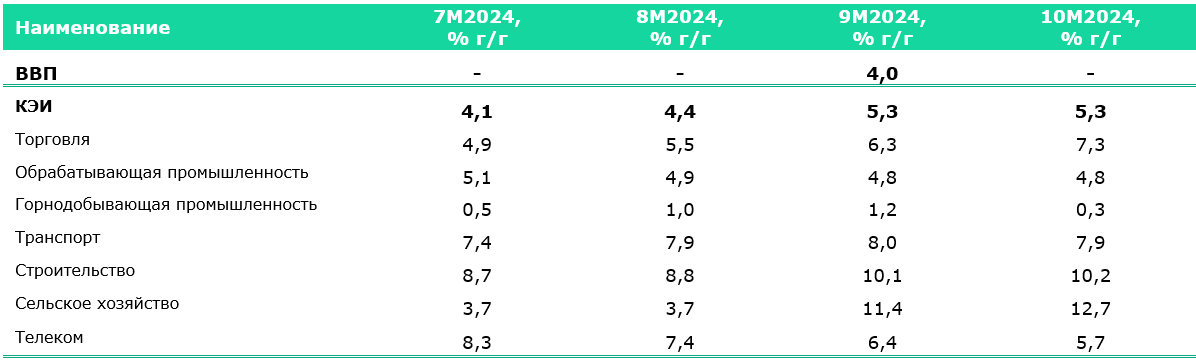

From January to October 2024, the short-term economic indicator (STEI) reached 5.3% year-on-year, mirroring the trends observed from January to September, as reported by inbusiness.kz citing the analytical center Halyk Finance.

The trade sector, particularly retail and its non-food segment, continues to exhibit abnormal growth rates. The manufacturing sector has maintained its growth pace, while the mining sector has sharply slowed down due to the repairs at Kashagan and the compensation of overproduction under OPEC+ commitments. Data on investments in fixed capital for the first ten months has not yet been published, but analysts do not expect significant changes given the low investment activity since the beginning of the year.

"Considering all balancing risks, we maintain our economic growth forecast at 3.9% by the end of the year. Despite the continued growth in trade indicators, the sharp decline in the mining sector is likely to offset this effect," the center stated.

According to BNS, the short-term economic indicator (STEI), which accounts for over 60% of GDP, stood at 5.3% year-on-year for the first ten months of the current year, repeating the dynamics of the previous period. Meanwhile, the government has not yet released data on GDP growth for January to October.

Fig. 1. Dynamics of GDP growth and sectors in 2024, %

Source: BNS

The trade sector continues to demonstrate abnormal growth rates, which increased from 6.3% year-on-year to 7.3% year-on-year over the ten-month period. The primary contribution to this growth came from retail trade, which saw its growth rate rise from 7.3% year-on-year for the first nine months of 2024 to 8.7% year-on-year for ten months. Within retail trade, the non-food goods sector exhibited significant growth, increasing to 8.5% year-on-year during the reporting period (6.7% year-on-year for 9M2024). Meanwhile, sales of food products in the retail segment accelerated to 8.9% year-on-year (8.4% year-on-year for 9M2024). The growth of wholesale trade for the first ten months of 2024 was 6.6% year-on-year compared to 5.7% year-on-year for January to September.

The manufacturing industry maintained a growth rate of 4.8% year-on-year from January to October. The mining industry, during the same period, sharply slowed to 0.3% year-on-year compared to 1.2% year-on-year previously. This is likely due to further reductions in oil production in the country amid a month-long repair of Kashagan and compensation for overproduction under OPEC+ commitments.

The construction and transportation sectors continue to show steady growth at 10.2% year-on-year and 7.9% year-on-year, respectively, nearly replicating the dynamics of the previous period. A slight slowdown in the latter is linked to a decrease in passenger traffic growth rates to 13.7% year-on-year (14.1% year-on-year for 9M2024). At the same time, the telecommunications sector slowed its growth from 6.4% year-on-year for the first nine months of 2024 to 5.7% year-on-year for ten months. This is primarily due to a continued decline in the mobile communications segment, where volumes decreased by 14.2% year-on-year (-13.1% year-on-year for 9M2024).

Agriculture continues to show quite high growth at 12.7% year-on-year (11.4% year-on-year for 9M2024). Besides issues related to misreporting in agriculture, the effect of a low base from the previous year should be noted: during the same period in 2023, the growth rate of the agricultural sector declined by 8.6% year-on-year.

"Overall, we maintain our economic growth forecast for the end of the year at 3.9% year-on-year. Despite the abnormal growth in trade for the second consecutive month, the main factor for the restrained forecast is the weak dynamics in the mining industry amid further stagnation in oil production. Another significant factor is investments in fixed capital, which grew by only 0.6% year-on-year for 9M2024, significantly lower than the same indicator from the previous year (12.1% year-on-year). The contribution of other sectors remains limited due to their small share in GDP, including agriculture and construction, which rely on state support," analysts from Halyk Finance summarize.