Investments in fixed capital (IFC) in the manufacturing industry, transport sector, and real estate, which together account for 47.5% of the total volume, have shown positive dynamics, reports inbusiness.kz citing the analytical center Halyk Finance.

At the same time, IFC in the mining sector, agriculture, and trade have continued to decline. Despite the growth, overall indicators remain significantly lower than last year's levels and below GDP growth, indicating a negative trend. Additionally, financing sources for IFC show an increase in the share of the state budget and borrowed funds, while the share of own funds has decreased, which is also an unfavorable factor.

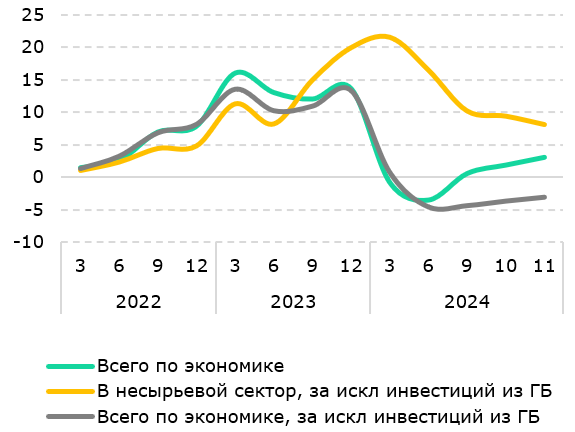

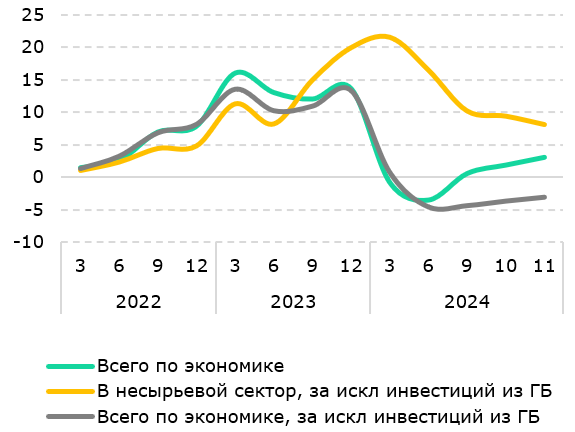

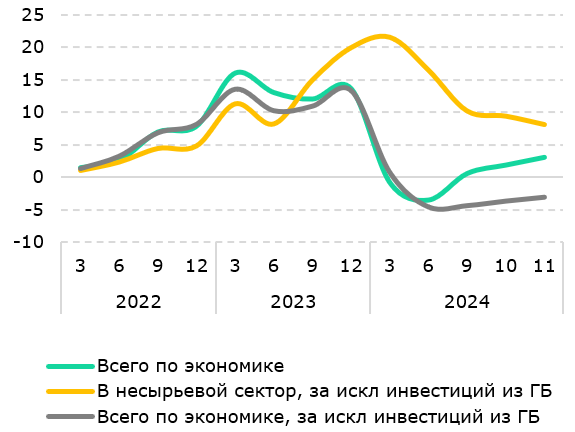

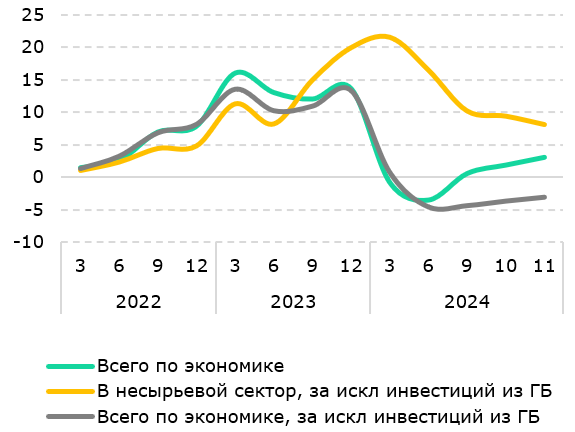

According to BNS data, the growth rate of investments in fixed capital in January-November 2024 accelerated to 3.1% year-on-year compared to a growth of 1.9% year-on-year the previous month. Nevertheless, this figure significantly lags behind the results of the same period in 2023, when investments increased by 14.6% year-on-year. This sharp slowdown is primarily linked to the decline in IFC in the mining sector, which fell by 23.3% year-on-year in the 11 months of 2024, compared to a growth of 1.4% year-on-year in the corresponding period last year. Negative dynamics have continued to be observed since the beginning of the year in IFC in trade and agriculture, which decreased by 17.7% year-on-year and 9.3% year-on-year respectively in the 11 months of 2024.

Positive growth in investments was noted in non-resource sectors. Thus, in the manufacturing industry, the growth rate in January-November of this year accelerated to 18% year-on-year, compared to a growth of 8.6% year-on-year in January-October. The largest contributions came from metallurgical production and automobile manufacturing. Due to the implementation of infrastructure projects, high investment growth was maintained in the transport sector: in the 11 months of 2024, they increased by 27.2% year-on-year compared to 30.4% year-on-year the previous month. Investments in education increased 2.5 times year-on-year, while investments in real estate operations accelerated to 7% year-on-year compared to 4.8% year-on-year over the ten months.

Fig. 1. Investments in fixed capital, % year-on-year cumulative

Source: BNS

Fig. 2. Structure of IFC by sectors for the 11 months of 2024, %

0

0

Source: BNS

IFC financing came from the state budget and borrowed funds, whereas last year it was primarily from the organizations' own funds. The share of funds from the state budget in the structure of financing sources for investments shows an upward trend, while the share of own funds is decreasing. Thus, in the 11 months of 2024, the share of investments from the state budget increased to 20.2% compared to 14.8% in the corresponding period last year. At the same time, it should be noted that investments from own funds include funds from state-owned companies, which often, by their nature, are quasi-budgetary funds. The decrease in the share of investments from the organizations' own funds is a negative trend that will hinder economic growth in the near future, considering the issues of the republican budget, analysts at HF note.

Fig. 3. Structure of sources of financing for investments in fixed capital, %

1

1

Source: BNS

Fig. 4. Share of investments in fixed capital to GDP, %

2

2

Source: BNS

Despite the fact that the growth of IFC has accelerated in recent months, it lags behind GDP growth, resulting in a decrease in the share of IFC to GDP, which is also an unfavorable factor for economic development. Overall, the share of investments to GDP remains low, hovering around 15%, while the government has a long-term target of 30% of GDP. Figure 4 illustrates the dynamics of the share of investments in fixed capital to GDP since 2005.

"In our opinion, it is necessary to reconsider the current diversification strategy, especially in the context of reducing dependence on oil and redirecting the economy to more innovative and technologically advanced sectors. This requires radical reforms in the country's tax and budget policy to ensure macroeconomic stability by reducing the budget's dependence on oil prices, as well as creating a full-fledged market environment that will promote the development of private entrepreneurship and attract private investments in high-tech sectors of the economy," writes analyst Dinara Sholanova.