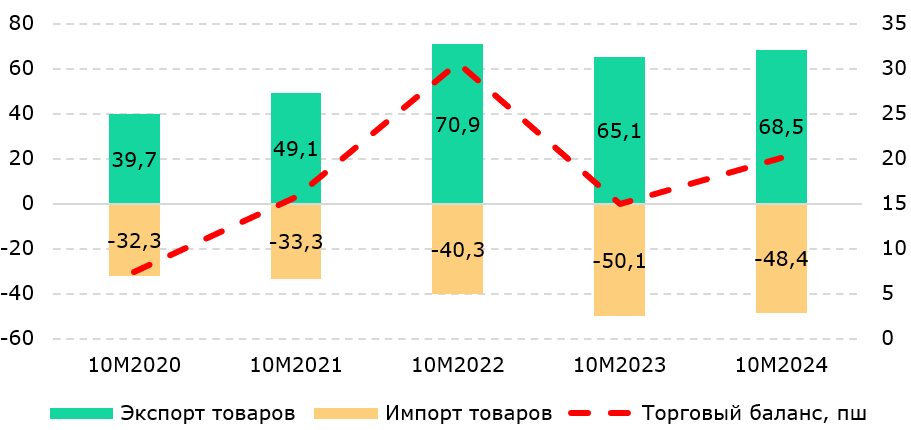

According to BNS, from January to October 2024, Kazakhstan's foreign trade balance recorded a surplus of $20.1 billion, which is one-third higher compared to the same period last year. This is a result of a decrease in imports alongside a slight increase in exports, as reported by inbusiness.kz referencing the analytical center Halyk Finance.

The negative trend in imports this year is linked to a reduction in the import of machinery and equipment, which is, in turn, due to a decline in investments in fixed capital and re-export operations with Russia. Overall, the raw material orientation of the economy continues to impact both export and import figures. Against this backdrop, government measures should focus on non-raw material exports, particularly on the export of medium- and high-tech goods, according to HF analysts.

For similar periods over the last four years, this is the highest value of the trade balance, except for 2022 when export volumes surged due to re-exports to Russia.

Fig. 1. Trade balance, $ billion

Source: BNS

The positive trade balance this year has resulted from an increase in exports while imports have simultaneously decreased. Over the first 10 months of 2024, export volumes grew by 5.1% year-on-year, reaching $68.5 billion (up from $65.1 billion for the same period in 2023). However, the monthly export dynamics show some volatility: after an increase in exports of 5.1% month-on-month in August and 9.5% month-on-month in September, exports dropped by 10.1% month-on-month in October to $7.1 billion. Consequently, from the beginning of the year, there has been a positive, albeit weak, trend in commodity exports.

Import volumes for goods over the first 10 months of 2024 totaled $48.4 billion, down 3.3% year-on-year (compared to $50.1 billion for the same period in 2023). Monthly import dynamics exhibit a trend opposite to that of exports. In August, import volumes decreased by 0.4% month-on-month. In September, imports fell by 5.6% month-on-month, while in October they rose by 12.7% month-on-month to $5.4 billion, surpassing all monthly figures for 2024. As a result, this has restrained imports from experiencing a more significant year-on-year reduction.

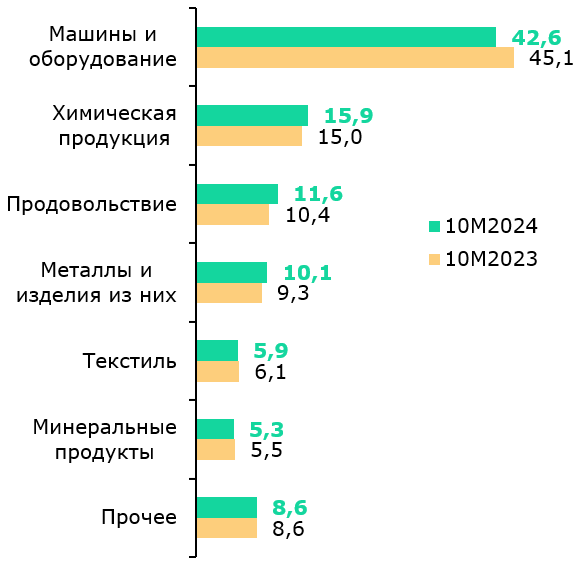

The key reason for the decline in import volumes since the beginning of the year is the decrease in the import of machinery and equipment, which accounts for the largest share at 42.6% of total imports. This is connected to a reduction in investments in fixed capital, particularly in the mining sector, as well as a decline in re-export operations with Russia. Over the first 10 months of 2024, imports of machinery and equipment decreased by 8.7% year-on-year, or by $2.0 billion in absolute terms, along with declines in textile categories (-$0.1 billion) and leather raw materials (-$0.1 billion). Meanwhile, food imports during the reporting period increased by 7.3% year-on-year (+$0.4 billion), and chemical products rose by 2.4% year-on-year (+$0.2 billion), partially offsetting the reductions in other categories.

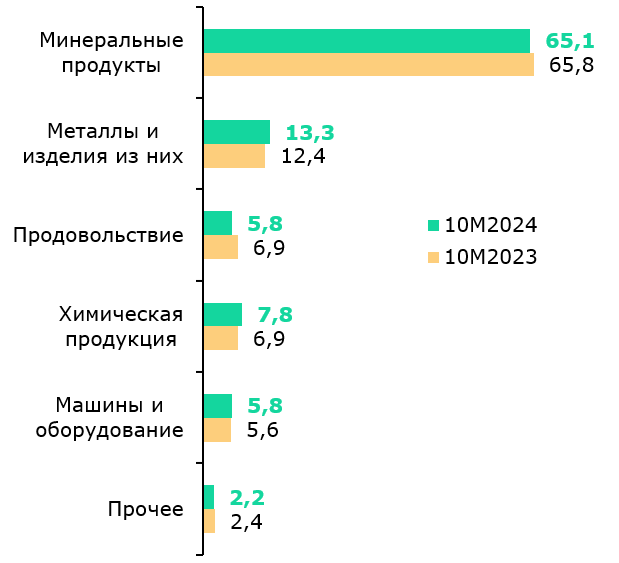

On the other hand, the country's exports have been supported by high oil prices since the beginning of the year, which, despite a decline in recent months, averaged $81 per barrel over the first 10 months of 2024. Consequently, Kazakhstan's oil export revenues for the same period increased by 6.5% year-on-year to $37.2 billion. During the reporting period, metal exports rose by 13.4% year-on-year (+$1.1 billion). Exports of chemical products grew by 18.0% year-on-year, while machinery and equipment exports increased by 7.2% year-on-year (+$0.3 billion). The most significant decrease in exports was observed for food products, which fell by 12.1% year-on-year, or by $0.5 billion, amid government restrictions.

"Overall, the structure of Kazakhstan's exports still exhibits a pronounced raw material character. The main export goods of the country continue to be mineral products, low-processed metals, and unprocessed food, whose combined share in exports this year exceeded 80%. In our view, to reduce the economy's dependence on global raw material prices, government support measures should be directed towards non-raw material exports, particularly in the export of medium- and high-tech goods, whose dynamics should become the main indicator of the effectiveness of the country’s industrial policy," said analyst Sanjar Kaldarov.

Fig. 2. Structure of imports by product groups, %

Source: BNS

Fig. 3. Structure of exports by product groups, %

Source: BNS

Until the end of 2024, Halyk Finance analysts do not expect significant changes in the structure and volumes of foreign trade, particularly regarding exports. Despite the depreciation of the tenge, which should, in principle, support exports, oil production continues to stagnate, and oil prices have sharply declined following the results of the US elections and a decrease in demand from China. Overall, further improvement in the trade balance could lead to a reduction in the current account deficit to 1.3% of GDP.