The short-term economic indicator (STEI), reflecting the dynamics of key sectors of the economy, slowed down in January to 4.5% year-on-year compared to 6.2% at the end of 2024. The slowdown was observed across most sectors, as reported by inbusiness.kz citing the analytical center Halyk Finance.

"The main reasons for the slowdown were the decrease in trade growth rates, persistently low dynamics in the mining sector, and weak investment activity. The effect of increased government spending in the second half of 2024 was short-lived, only supporting annual growth figures. The main driver of growth was the transportation sector, which demonstrated record dynamics. According to the forecast by the government of Kazakhstan, real GDP growth in 2025 is expected to be 5.6% due to extensive economic growth and fiscal incentives," writes analyst Saltanat Igenbekova.

Analysts at HF predict economic growth in 2025 at 5.3%, supported by the planned increase in oil production, fiscal stimulus, and the implementation of large infrastructure projects.

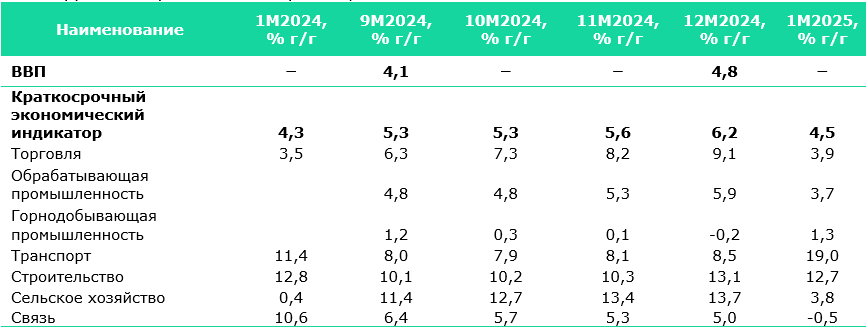

The economy of Kazakhstan began 2025 with a slowdown: according to the national statistics bureau, the short-term economic indicator (STEI), which accounts for over 60% of GDP, stood at 4.5% year-on-year in January, which is almost equivalent to the January STEI value of 2024 (4.3% year-on-year) and significantly lower than the STEI of 6.2% at the end of 2024. A decrease in growth rates was observed in nearly all sectors, except for the mining industry, which showed a growth of 1.3% year-on-year, and transportation (19% year-on-year). Investments in fixed capital also exhibited weak growth – 0.2% year-on-year (January 2024 – 0.6% year-on-year), continuing the trend of declining growth rates since 2023.

Fig. 1. Dynamics of GDP and sector growth, %

Source: NSB

Source: NSB

The trade sector significantly slowed its growth rate to 3.9% year-on-year after a relatively high growth in the second half of 2024, which corresponds to historical January values. At the same time, retail trade showed predominant growth (4.2% year-on-year), while wholesale trade volumes increased by 3.8% year-on-year. Within the structure of retail trade, significant growth was observed in the food products sector, which increased by 8.8% compared to January 2024, while sales of non-food products showed modest growth of 2.5% year-on-year.

After a decline in dynamics in the last quarter of 2024, the mining industry restored its growth rate to 1.3% year-on-year due to increased oil production as part of a one-time testing of a new plant at the Tengiz field. Oil production increased by 4.4% compared to December 2024 (a decrease of 1.1% compared to January 2024). It should be noted that Kazakhstan exceeded its quota under the OPEC+ agreement, increasing its average daily oil production (excluding gas condensate) in January 2025 by 5% compared to December 2024, reaching 1.538 million barrels from 1.465 million barrels in December 2024. Therefore, the Ministry of Energy must present a plan to compensate for the overproduction of oil. As a result, the previously planned expansion of oil production in 2025 and the associated forecasted economic growth remain uncertain.

Overall, the mining industry in January reduced production volumes by 2.6% compared to December 2024, which, considering the predominant role of the sector in the country's GDP, significantly influenced the low growth rates of the economy in January 2025.

The construction and transportation sectors continue to show steady growth at 12.7% year-on-year and 19.0% year-on-year, respectively, nearly replicating the dynamics of the previous period. The transportation sector emerged as the main driver of economic growth in January 2025, achieving a record value over the past three years. The previous double-digit growth in the sector was observed in January of the previous year – 11.4%. The main growth in the sector occurred due to an increase in passenger turnover by 15% year-on-year and cargo turnover by 13.8% year-on-year (mainly in the road transport sector).

The communications sector showed a decline in production volumes by 0.5% year-on-year, continuing the annual downward trend (in January 2024, growth was 10.6% year-on-year). This is primarily related to a further decline in the mobile communications segment, where volumes decreased by 25.6% year-on-year (-15.8% year-on-year for 2024).

In agriculture, growth was 3.8% year-on-year (0.4% year-on-year in January 2024) due to an increase in livestock production volumes by 4.1% year-on-year, driven by an increase in the number of cattle.

In 2025, the government forecasts economic growth at 5.6%, mainly due to further growth in the manufacturing sector, budget incentives, and increased oil production, which is quite optimistic amid the need to comply with commitments under OPEC+ and the revision of plans to compensate for oil overproduction.

"Our forecast for economic growth in 2025 is 5.3%, taking into account the factors that restrain growth, including the possible decline in oil prices, the maintenance of tight monetary conditions against a backdrop of high inflationary risks, and a relatively low level of investment and productivity," summarizes the analytical center.