Analysts from BCC Invest commented on the planned tax reforms announced at an extended government meeting on January 28, as reported by the correspondent of the business information center Kapital.kz, referencing data from the company.

The meeting stated that the value-added tax (VAT) rate would be increased. This reform will lead to higher production costs, "therefore, the government proposes to abolish the social tax and mandatory pension contributions from employers."

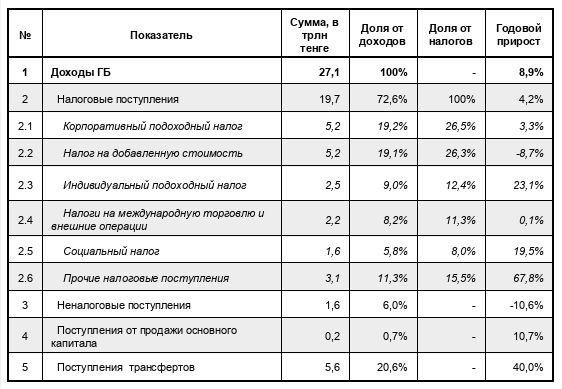

"The Analytics and Research Department of BCC Invest monitors the impact of external and internal factors on the economy of Kazakhstan as part of its monthly work on tracking and forecasting macroeconomic indicators. According to the Ministry of Finance, state budget revenues (GB) amounted to 27.1 trillion tenge, which is an increase of 2.2 trillion tenge or 8.9% compared to 2023," the experts note.

The revenues consist of:

Experts emphasize that the majority of GB revenues come from tax receipts, which is a positive factor; however, it is important to highlight that one-fifth of GB revenues are transfers from the National Fund (NF). This indicates a high dependency of the budget on oil revenues, which creates risks for its stability in the event of a potential drop in commodity prices.

At the extended government meeting, Deputy Prime Minister – Minister of National Economy Serik Jumangarin announced that as part of the reform, the VAT rate is expected to increase while abolishing the social tax and mandatory pension contributions from employers. The president noted that the proposed tax reforms could replenish the budget without additional transfers.

In 2024, the government increased the volume of targeted transfers from 1.6 trillion tenge to 3.6 trillion tenge to finance the state budget. Additional transfers of 2 trillion tenge accounted for 7.4% of total GB revenues.

Overall, the share of social tax and additional transfers in 2024 constitutes 13.2% of GB revenues. This means that the increase in the VAT rate from 12% to 20% should compensate for this difference. If a hypothetical calculation is made, then by the end of 2024, at a 12% VAT rate, it would amount to 5.2 trillion tenge; accordingly, by proportion, at a 20% VAT rate, it could reach 8.6 trillion tenge, which would be 31.8% of total GB revenues. The share of VAT would increase from 19.1% to 31.8%, or by 12.7 percentage points.

In total, GB expenditures amounted to 30.7 trillion tenge, which is an increase of 3.0 trillion tenge or 10.8% compared to the results of 2023. The expenditures consist of:

- expenses – 30.3 trillion tenge or 98.7% of GB expenditures;

- net budget lending – 198.4 billion tenge or 0.6%;

- balance from operations with financial assets – 201.6 billion tenge or 0.7%.

In fact, half, specifically 50.3% of all expenditures, are social expenditures ("Education," "Healthcare," and "Social assistance and social services"). This indicates that the state allocates more funds to the social component, as emphasized by Prime Minister Olzhas Bektenov.

In 2024, the budget deficit amounted to -3.6 trillion tenge, which is an increase of 774.9 billion tenge or 27.6% compared to 2023.

"During the meeting, plans to raise the VAT rate from the current 12% to 20% were discussed. Such a move may be justified in terms of increasing budget revenues, but its impact on the business environment and consumers is questionable. On one hand, the reduction of social taxes and pension contributions from employers should offset the burden on businesses. On the other hand, the rise in VAT will inevitably increase final prices for consumers, which will intensify inflationary pressure. According to the calculations provided, as a result of the VAT rate increase, inflation could rise by 4%," analysts indicate.

Earlier, Prime Minister Olzhas Bektenov stated the need to implement a comprehensive set of measures to improve the tax and budget system. He believes that the main tax burden falls on the wage fund, and thus on production costs. "Even before the product hits the shelf, the entrepreneur is already forced to pay a large portion of taxes. The government proposes to reduce the burden on the wage fund by shifting it to sales. To do this, it is necessary to raise the VAT rate, while simultaneously reducing the social tax and mandatory pension contributions from employers," said Olzhas Bektenov.

Deputy Prime Minister – Minister of National Economy Serik Jumangarin explained that they intend to reduce the burden on the wage fund by up to 30%. They also propose to lower the VAT threshold from 78 million to 15 million tenge.