Deputy Minister of National Economy Azamat Amrin spoke at the Mazhilis about the tax reform and which sectors can expect a reduced VAT rate, as reported by a correspondent from the Kapital.kz business information center.

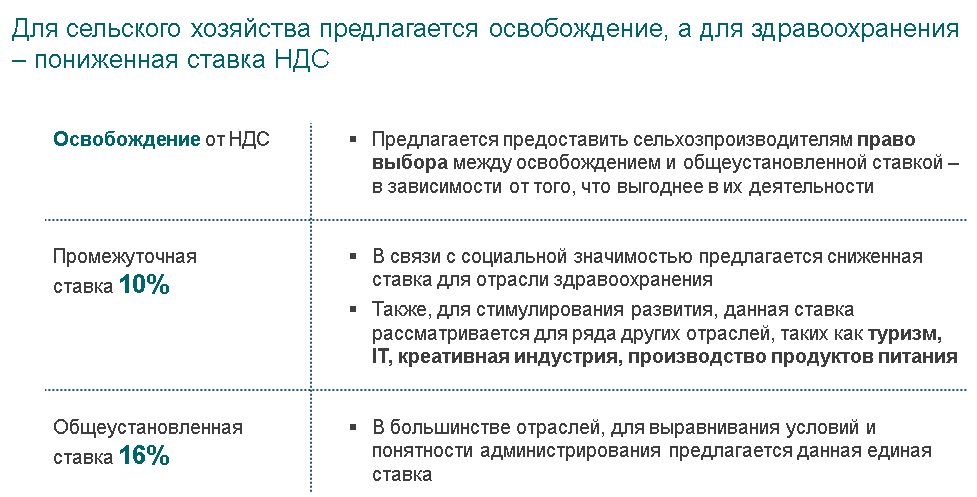

“We propose a differentiated VAT rate. The standard rate will be 16% - this is the base rate. The second option is a complete exemption from VAT for the agro-industrial complex. At the same time, we maintain the right to voluntary registration (for the AIC - Ed.). This means that if a taxpayer wishes to be a VAT payer voluntarily, they retain that right. An intermediate rate of 10% is also provided. In the draft submitted to parliament, this rate is proposed for the healthcare sector,” said Azamat Amrin during the presentation of amendments to the Tax Code.

He explained that many proposals were received from local entrepreneurs during meetings with businesses in the regions.

“In this case, initiatives have been voiced to reduce VAT on food products and other categories of goods. All these issues are currently under discussion. I believe that within the framework of the specialized group in the Mazhilis of Parliament, we will thoroughly consider all these proposals,” noted Azamat Amrin.

According to materials disseminated by the Mazhilis press service, it was stated that “to stimulate development, the intermediate rate of 10% is being considered for a number of other sectors, such as tourism, IT, the creative industry, and food production.”

Earlier in the Republic of Kazakhstan, the issue of increasing the VAT rate from 12% to 20% was considered, while there were intentions to reduce the burden on the wage fund to 30%. Additionally, Deputy Prime Minister - Minister of National Economy Serik Zhumangarin suggested lowering the VAT threshold to 15 million tenge. During a meeting with entrepreneurs on January 28, 2025, President Kassym-Jomart Tokayev stated that any innovations should be based on comprehensive analysis and a well-thought-out strategy and instructed the government to further work on the VAT rate issue.

On February 11, 2025, Serik Zhumangarin stated at a government meeting that the value-added tax rate “will be differentiated: 16%, 10%, 0%, and exemption from VAT.” It was also reported that in the construction sector, a social infrastructure payment (SIP) is planned to be implemented instead of VAT.

The proposed reform regarding the cancellation of social tax and OPRV payments by entrepreneurs could have occurred on the condition of raising VAT to 20%. In that case, the state would have revenues to cover social contributions instead of the employer. However, with the currently proposed VAT rate of 16%, it is suggested to leave social contributions unchanged.

The Ministry of Finance of Kazakhstan is also considering issues related to reducing ineffective tax benefits and differentiating the personal income tax depending on the income of individuals.

It was also reported that a reduced income tax rate is being introduced for manufacturers of domestically produced goods, and raw material processors will receive a VAT deferral on imported equipment.