In Kazakhstan, there are various types of tax deductions and tax obligations related to individual income tax. Fingramota.kz explains how taxpayers can take advantage of these tax deductions.

Tax deductions are a means to reduce the taxable base, which in turn lowers the amount of individual income tax (IIT) withheld from individuals' earnings. This serves as a kind of benefit or support from the state, allowing individuals to pay less tax and consequently receive more income.

Let's explore the main categories of deductions, the conditions for their application, and the process for obtaining them. It is important to note that tax deductions are applied sequentially in the order outlined in paragraph 1 of Article 342 of the Tax Code.

Deduction for Mandatory Pension Contributions (MPC)

Monthly, the employer withholds 10% from the employee's income for mandatory pension contributions. This amount is deducted from the taxable base. Example: with an income of 350,000 tenge, the pension contributions will amount to 35,000 tenge. After applying the MPC deduction, the taxable base will be: 350,000 – 35,000 = 315,000 tenge.

Deduction for Contributions to Mandatory Social Medical Insurance

The amount for contributions to mandatory medical insurance is 2% of income. This amount also reduces the taxable base. Calculation example: with an income of 350,000 tenge, the medical insurance contributions will total 7,000 tenge. The taxable base after the aforementioned deductions will be: 350,000 – 35,000 - 7,000 = 308,000 tenge. The IIT will be calculated on this amount at a rate of 10%, which will be withheld by the employer (tax agent) or paid independently by the individual.

Standard Tax Deduction

This deduction is granted to most taxpayers and is applied monthly. The size of the standard deduction is equal to 14 MRP (monthly calculation indicators). MRP is the monthly calculation indicator, which in 2025 amounts to 3,932 tenge. Thus, the standard tax deduction in 2025 will be 55,048 tenge (14 MRP * 3,932).

How does it work? If your salary is, for example, 350,000 tenge, then before calculating IIT, the standard deduction (in 2025, 1 MRP = 3,932 tenge, 14 MRP = 55,048 tenge) is subtracted from this amount. After applying the aforementioned deductions and the standard deduction, the taxable base will be: 350,000 - 35,000 – 7,000 - 55,048 = 252,952 tenge.

Additionally, standard tax deductions include deductions of 882 MRP for certain categories of citizens, including persons with disabilities, World War II veterans, parents or guardians of children with disabilities, etc.

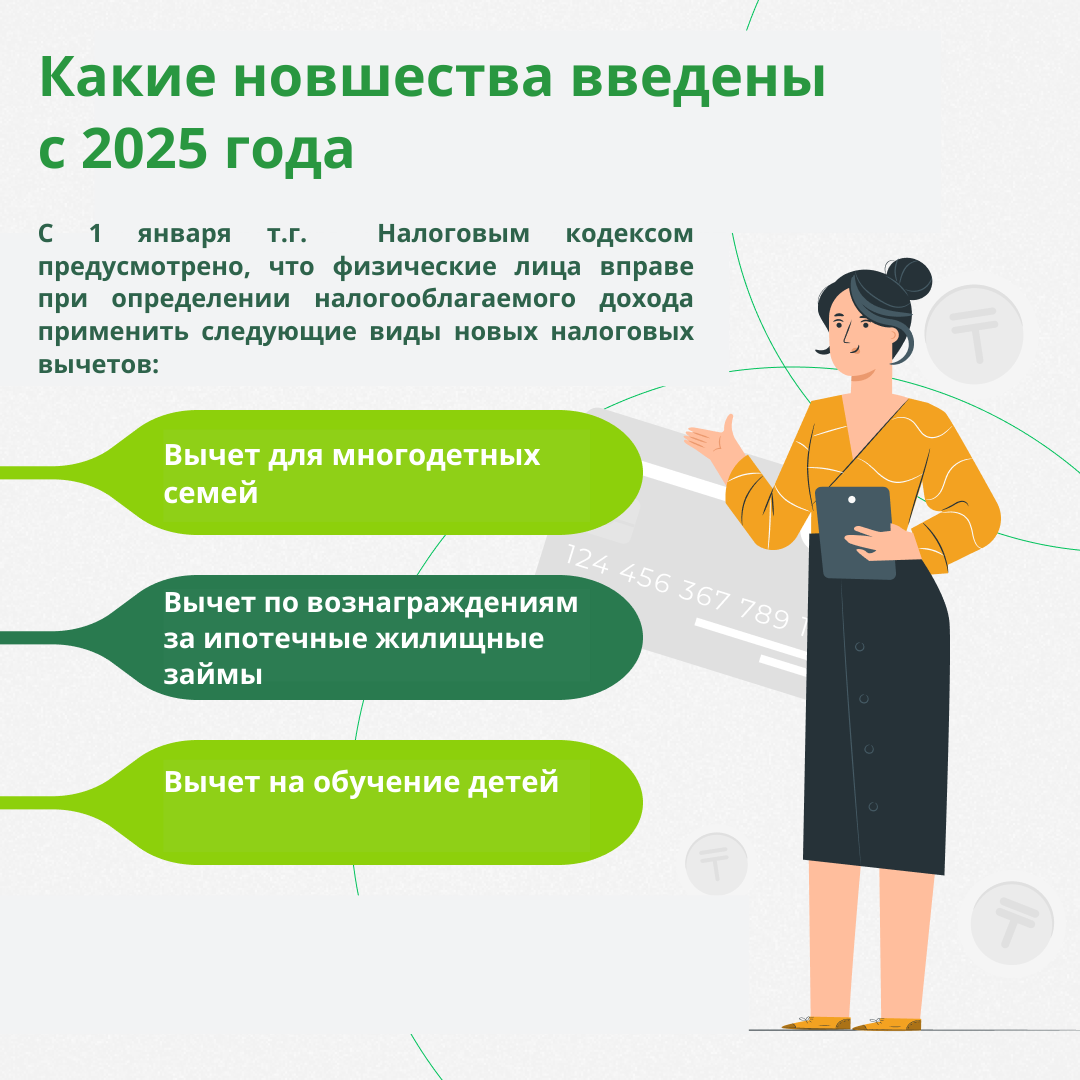

What New Changes Are Introduced from 2025

Starting from this year, the Tax Code allows individuals to apply the following new types of tax deductions when determining taxable income:

Deduction for Large Families

From January 1, 2025, a new regulation is in effect in Kazakhstan that allows for a reduction in the tax burden on the family budget of large families. According to the new rules, large families (provided that they have four or more minor children) are entitled to an additional deduction (Article 347 of the Tax Code). The tax deduction for large families is applied collectively to both parents in an amount not exceeding 282 MRP (in 2025 - 1,108,824 tenge) in one of the following ways:

- for one parent of the large family in the amount of 23 MRP (in 2025 - 90,436 tenge) per month;

- for each parent of the large family in the amount of 12 MRP (in 2025 - 47,184 tenge) per month.

It is important to note that the tax deduction applies if the individual has four or more minor children as of January 1 of the calendar year in which the deduction is applied, which is confirmed by copies of birth certificates. For the employer to start applying this deduction, the employee must provide a request for the tax deduction and supporting documents to the HR department or accounting.

Example: with an income of 350,000 tenge, the monthly deduction for a large family will be 90,436 tenge (23 MRP), reducing the taxable base to 259,564 tenge.

Deduction for Mortgage Loan Interest and Education

Changes also include the introduction of deductions for mortgage loan interest. Previously, citizens received deductions exclusively for mortgage loans issued by Otbasy Bank. However, starting January 1, 2025, citizens will be able to receive tax deductions regardless of the bank (up to 118 MRP per year) where the mortgage loan was obtained (Article 351 of the Tax Code of the Republic of Kazakhstan).

Each mortgage payment consists of two parts: the principal amount — the sum borrowed, and the bank's interest — the fees for using the money. The deduction can only be obtained on the bank's interest.

Example: if the monthly mortgage payment is 350,000 tenge, of which 150,000 tenge is interest and 200,000 tenge is the principal. The tax deduction will be calculated only on the interest amount.

How much can be saved? The deduction amount is capped at 118 times the monthly calculation indicator (MRP) per calendar year. This means the maximum deduction amount for tax calculation will be: 118 × 3,932 = 463,976 tenge.

How does the limit work? If you paid interest of 350,000 tenge in a year, you will receive a deduction for the entire amount (within the limit of 118 MRP). If the interest amount was 500,000 tenge (exceeding 118 MRP), the deduction will be limited to 463,976 tenge.

Let's break it down with an example excluding other tax deductions: if your monthly salary is 700,000 tenge, you will pay 10% income tax on 840,000 tenge annually (700,000 × 12 × 10%) (without applying deductions and adjustments). By applying the interest deduction, the taxable base for tax calculation will be reduced by the amount of interest actually paid on the mortgage loan (if the annual interest does not exceed 118 MRP) or 463,976 tenge (if the annual interest exceeds 118 MRP).

The education tax deduction (in the Republic of Kazakhstan for preschool education and training, technical and vocational education, post-secondary, higher education, including in autonomous educational organizations) applies within 118 MRP per year for tuition fees paid by an individual for themselves or by a legal representative for a resident individual of the Republic of Kazakhstan who is under 21 years old and dependent. If an individual under 21 applies for the education tax deduction, the said tax deduction may not be applied by the legal representative.

It was recently announced that Otbasy Bank is launching a new housing program "Nauryz Zhumysker" for employees in the industries of manufacturing, energy, transport, agriculture, and water resources.

At the beginning of January 2025, Prime Minister Olzhas Bektenov instructed the ministries of industry, energy, transport, agriculture, and water resources to work together with enterprises, akimats, and Otbasy Bank on launching preferential programs for mortgage and rental housing for the workforce.